Canadian employers face rising scrutiny under the Temporary Foreign Worker Program (TFWP). Since 2020, the number of inspections has increased by over 50%, and the average fine for non-compliance now exceeds $75,000 per violation.

Whether you oversee HR for a national construction firm, a logistics operation, or a growing technology company, proactive preparation is not optional; it is essential.

This comprehensive guide provides a clear, step-by-step framework, rooted in real enforcement cases, to help you protect your organization.

What you will find in this article

- What Triggers an Inspection?

- What Inspectors Will Examine

- How to Prepare Before You Receive Notice

- Industry-Specific Preparation Tips

- Immediate Steps Once You Are Notified

- During the Inspection

- What Inspectors Are Really Looking For

- After the Inspection

- Common Pitfalls to Avoid

- Templates and Tools to Streamline Compliance

- Take Action Today

What Triggers an Inspection?

Many HR managers underestimate how easily an inspection can be triggered. Contrary to popular belief, most audits are not random, they often result from recurring patterns in LMIA applications or unresolved worker complaints. Even organizations with strong reputations are subject to review when red flags appear. Understanding the most common triggers will help you assess your risk profile and address potential vulnerabilities proactively.

| Trigger Type | Description |

| Random Selection | Routine audits to verify program integrity |

| Complaints | Reports from workers, unions, or other third parties |

| LMIA Patterns | Repeated applications for similar roles or flagged NOC codes |

| Prior Violations | History of non-compliance increases future audit likelihood |

| Anonymous Tips | Verified or anonymous tips submitted to Service Canada |

Tip: Even a single discrepancy can escalate into a multi-year suspension.

What Inspectors Will Examine

Inspections are thorough and detail-oriented. Inspectors have the authority to review virtually any record connected to your temporary foreign workers. They will look for consistency across all your documentation; if contracts, pay stubs, and job descriptions don’t align, this can be interpreted as non-compliance. To prepare effectively, you must know exactly which records will be requested and maintain them in an organized system.

| Documentation Area | Examples of Required Records |

| Employment Contracts | Signed agreements outlining wages and duties |

| Payroll Records | Pay stubs, direct deposit proofs, CRA remittances |

| Recruitment Documentation | Job postings, interview notes, selection rationale |

| Credential Verification | Licenses, certificates, equivalency assessments |

| Health & Safety Training | WHMIS records, equipment training logs |

| Working Conditions Evidence | Timesheets, schedules, records showing compliance with LMIA commitments |

Real Example: A national retailer was fined $50,000 after inspectors found wages were inconsistent with LMIA documentation.

How to Prepare Before You Receive Notice

Preparation should never begin the day you receive a notice. Instead, it must be built into your HR processes and revisited regularly. Employers who stay organized and up to date are far better equipped to respond calmly and efficiently when inspectors arrive. The following best practices help ensure your company is ready at any time, regardless of whether the inspection is announced or a surprise.

Preparation Steps

- Create a central compliance binder (digital and paper)

- Assign a primary compliance officer and a backup contact

- Conduct internal audits every 6–12 months

- Review and update LMIA records and job descriptions quarterly

- Maintain all recruitment evidence for each position

- Document training, onboarding, and role assignments consistently

Tip: Well-organized records can reduce audit duration by up to 40%.

Industry-Specific Preparation Tips

Every sector faces unique compliance risks and operational realities. A preparation strategy that works in a technology company may fail in construction or manufacturing. HR managers should tailor their compliance programs to address the specific documentation, record-keeping, and oversight requirements of their industry. Here’s how leaders in each sector can strengthen their readiness and minimize exposure.

Transportation and Trucking

The transportation sector faces complex operational demands, long routes, fluctuating schedules, and heavy documentation requirements. HR teams in trucking must be especially diligent in tracking work hours, maintaining accurate pay records, and clearly defining employment relationships to avoid costly missteps.

- Use GPS-integrated logs linked to payroll systems.

- Attach route schedules and trip assignments to each worker’s file.

- Reassess contractor vs. employee classifications annually.

Construction

Construction employers are often challenged by fast-paced projects and layered subcontracting. Without clear agreements and thorough record-keeping, it’s easy for job duties and wages to drift outside approved LMIA terms, triggering heightened scrutiny.

- Draft subcontractor agreements clearly referencing LMIA compliance.

- Track site-specific orientations and safety training.

- Update job descriptions whenever duties change.

Healthcare

Healthcare organizations operate under rigorous credential and privacy standards. Compliance requires not only verifying qualifications but also protecting sensitive personal information, while ensuring that every role aligns with LMIA commitments.

- Verify credential equivalency before onboarding staff.

- Store certifications securely in compliance with privacy regulations.

- Maintain professional development records consistently.

Technology

Rapid growth and dynamic work environments make tech companies vulnerable to compliance gaps. Assumptions about exemptions or contractor status can quickly lead to penalties if they are not backed by clear evidence and consistent documentation.

- Confirm LMIA exemptions for each high-skilled role.

- Use standardized offer letters with clear compensation details.

- Retain recruitment and posting records.

Manufacturing

In manufacturing, seasonal peaks and high-volume staffing can strain record-keeping systems. Employers must be vigilant in tracking training, overtime, and NOC alignment to maintain compliance as work demands shift.

- Implement time-tracking systems for seasonal staff.

- Keep job descriptions aligned with NOC codes.

- Retain safety and training logs for all employees.

Immediate Steps Once You Are Notified

Receiving an inspection notice is not a cause for panic, but it does require swift, organized action. Clear communication, a defined chain of responsibility, and precise documentation are critical in demonstrating your company’s good faith and commitment to compliance. Use this process to guide your first response in the critical hours and days after notification.

- Acknowledge Receipt: Confirm in writing you have received the notice.

- Review Scope and Deadlines: Determine which years, employees, and documents are covered.

- Secure Documentation: Gather contracts, payroll records, recruitment files, and training logs.

- Notify Leadership: Inform your compliance lead and executive sponsor.

- Assign Roles: Designate a point person to liaise with inspectors.

- Prepare Employees: Brief staff and managers about expected interviews.

- Confirm Timelines: Most responses are due within 30 days.

During the Inspection

Inspections can be stressful, especially for large employers with multiple worksites. Inspectors will ask detailed questions, request clarifications, and expect prompt cooperation. Your response should be professional, transparent, and meticulously documented. This approach demonstrates that your organization takes compliance seriously and is prepared to remedy any deficiencies.

Best Practices:

- Be transparent and professional at all times.

- Keep a log of every request and document submission.

- Provide requested materials promptly.

- Avoid speculating, verify details before responding.

What Inspectors Are Really Looking For

Although inspections cover many areas, inspectors often focus on a core set of risk indicators that reveal systemic weaknesses. Knowing what they prioritize can help you prepare more effectively and avoid common mistakes that trigger deeper investigations or larger penalties.

- Wage Consistency: Do pay stubs, LMIA applications, and contracts match exactly?

- Role Alignment: Are employees performing only the duties approved in the LMIA?

- Record Organization: Can you retrieve documents within 48 hours?

- Credential Proof: Are licenses and certifications current and verified?

- Recruitment Evidence: Do you have clear proof that Canadians were considered first?

Tip: Poor record-keeping or vague responses often lead to escalated audits and reputational damage.

After the Inspection

After the inspection, you will receive a formal report outlining any findings and next steps. It is essential to read the report carefully, clarify any uncertainties immediately, and begin remedial measures if necessary. Companies that respond professionally and promptly often see more favorable outcomes, even if issues are identified.

Inspectors will issue:

- A Compliance Report summarizing findings

- A Notice of Non-Compliance, if applicable

- Instructions and timelines for response or appeal

Statistic: In recent years, 21% of audited employers have received penalties or suspensions.

Common Pitfalls to Avoid

Most enforcement actions stem from a predictable set of errors. By recognizing and addressing these pitfalls, HR leaders can significantly reduce the likelihood of penalties.

| Pitfall | How to Avoid It |

| Incomplete Records | Use a checklist to ensure all documents are retained. |

| Wage Discrepancies | Audit payroll every quarter for accuracy. |

| Duty Drift | Update job descriptions whenever roles evolve. |

| Delayed Responses | Assign a compliance coordinator to track deadlines. |

| Poor Communication | Train managers and employees on inspection expectations. |

Example:

A construction firm was suspended for three years simply because it failed to reply to multiple emails requesting clarification.

Templates and Tools to Streamline Compliance

Your preparation is only as good as your resources. Equip your team with the tools they need to stay organized and confident:

- Record-Keeping Checklist PDF

- Sample Inspection Response Letter

- LMIA-Compliant Employment Contract Template

Tip: Store all resources in a centralized compliance folder accessible to key staff.

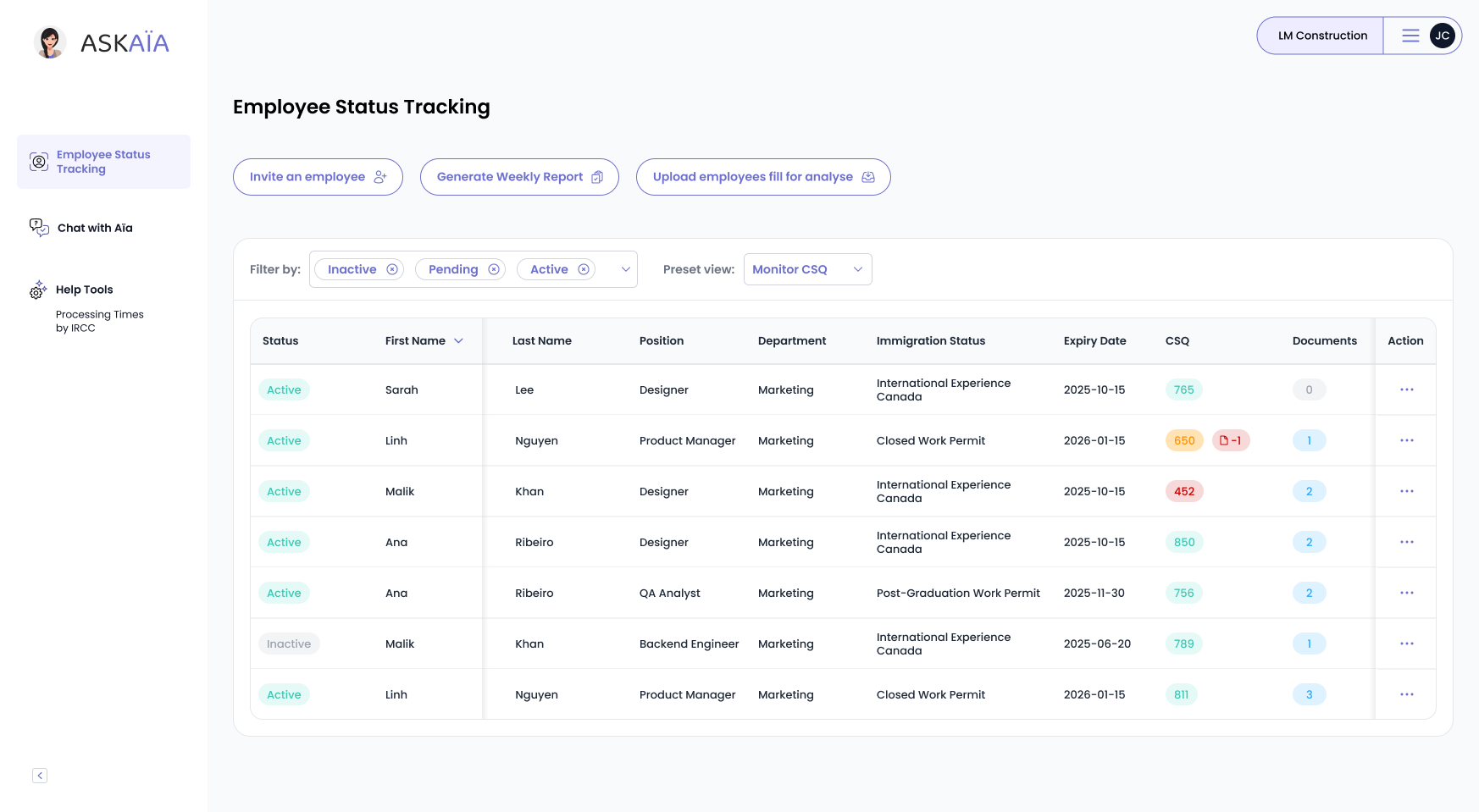

Take Action Today

Even reputable, well-resourced employers have faced penalties for preventable mistakes. The best defense is readiness. Book a free immigration compliance consult with the experts on our team.

Let’s get your demo started

Book a demo

You May Also Like

These Related Stories

Act Fast: Canada Delays PGWP Program Removal to Early 2026

At a Glance " \n Canada postponed the removal of 178 study programs from PGWP eligibility to early 2026. \n This gives students extra time to graduate …

Top Compliance Risks in Key Canadian Industries

Compliance failures don’t look the same in every sector. From trucking fleets to healthcare providers, each industry faces unique vulnerabilities that …

Canada Updates PGWP: 119 New Programs Added, 178 Removed in 2025

Canada has announced substantial changes to the Post-Graduation Work Permit (PGWP) program that could reshape the future of thousands of international …