Close Compliance Gaps Fast: Avoid Six-Figure TFW Penalties in Canada

Fines for paperwork lapses under Canada’s Temporary Foreign Worker Program (TFWP) have risen sharply, up 31 % year‑over‑year to $2.1 million, while employer bans have jumped five‑fold over the same period.

This guide helps HR teams spot and fix compliance gaps before inspectors arrive. You’ll see the latest inspection data, quick‑view tables, a six‑step self‑audit, and guidance on when to involve professionals, so talent keeps flowing and reputations stay intact.

At a Glance

- $2.1 M in fines & 20 bans in just six months—compliance pressure is at an all‑time high.

- Missing records, wage errors & housing lapses top inspectors’ violation list.

- Quarterly self‑audits and voluntary disclosure can slash penalties and protect contracts.

Context: Enforcement Surge

Between April 1 and September 30, 2024, federal officers completed 649 inspections; 11 % failed, bringing $2.1 million in fines and 20 bans, five times last year’s count.

For the 2023‑24 fiscal year, the program logged 2,122 inspections and $2.1 million in penalties, up 31 % from $1.54 million the year before, highlighting a steep upward trend.

Ottawa can now suspend positive LMIAs on suspicion of fraud and, since fall 2024, levy up to $ 45,000 per worker when employers refuse to cooperate.

Compliance Snapshot: Key Numbers

| Metric | 2022‑23 (FY) | 2023‑24 (FY) | Apr–Sep 2024 | Trend |

| Inspections | 2 100+ | 2 122 | 649 | - |

| Non‑compliance | 5 % | 6 % | 11 % | ▲ 83 % |

| Monetary penalties | $1.54 M | $2.1 M | $2.1 M* | ▲ 36 % |

| Employer bans | 7 | 12 | 20* | ▲ 186 % |

*Six‑month snapshot.

Recent High‑Profile Penalties (2024)

Below are the five sectors that appear most often in ESDC inspection summaries for 2023‑24, ranked by share of total violations. Each example is pulled from a public enforcement notice issued in the last 12 months.

| Rank | Sector | Share of violations* | Key violation | Fine & ban example |

| 1 | Agriculture | 24 % | Under‑payment & inadequate housing | $46 000 fine, 5‑year ban |

| 2 | Accommodation & Food Services | 22 % | Improper wages & recruiter fees | $152 000 fine, 2‑year ban |

| 3 |

Manufacturing/ |

14 % | Record‑keeping & safety breaches | $210 000 fine, 8‑year ban |

| 4 | Transportation & Warehousing | 11 % | Abuse‑free workplace failure | $135 000 fine, 10‑year ban |

| 5 | Hospitality (Hotels & Resorts) | 9 % | Housing conditions & overtime pay | $98 000 fine, 4‑year ban |

*Percentages derived from aggregated ESDC enforcement bulletins, FY 2023‑24.

Labour-intensive, lower-wage industries dominate the violation chart because they rely heavily on seasonal or shift-based roles, multiple worksites, and third-party recruiters, all factors that multiply paperwork and wage-tracking risks. These sectors dominate because they employ large numbers of temporary workers across various sites, rely on seasonal or shift-based schedules, and often use third-party recruiters, factors that multiply documentation and wage-tracking risks.

Together, these trends confirm that complexity, not company size, drives compliance risk; any HR team juggling multiple pay schemes, locations, or housing duties should treat audits as a near‑term certainty.

Penalty Tiers at a Glance

Federal sanctions fall into three escalating categories: administrative fines, time‑limited program bans, and permanent public listing. Each is scaled to the gravity and recurrence of the breach. Knowing where a violation sits on this ladder lets HR teams gauge financial risk, anticipate hiring delays, and budget remediation resources accordingly.

| Sanction | Range | Notes |

| Administrative Monetary Penalty | $500 – $100 000 per violation (max $1 M/year) | Assessed on severity & history |

| Program ban | 1 – 10 years or permanent | Applies to IMP & TFWP |

| Public non‑compliance listing | Indefinite | Employer posted on IRCC site |

Where Employers Slip Up

The biggest trip‑wire is missing paperwork—ESDC inspection summaries indicate that documentation issues remain the single most cited violation category, consistently topping the list of non‑compliance findings. Why is documentation so often deficient?

- Fragmented record systems – Payroll, recruitment, and legal teams store files in separate drives or email chains, making it easy for a single LMIA or payslip to fall through the cracks.

- High staff turnover – Front‑line HR coordinators change roles frequently; incoming staff may not know the six‑year retention rule or where legacy files are kept.

- Rule complexity – Employers juggle federal TFWP conditions and overlapping provincial rules (e.g. Québec’s CNESST housing standards), leading to confusion over which documents to keep

- Reliance on third‑party recruiters – When agencies control onboarding, employers often assume paperwork is handled off‑site and fail to copy the full file.

- Language and time‑zone gaps – International worksites or multilingual teams slow down document collection and translation, causing missed 30‑day deadlines.

- Under‑paying wages and ignoring health‑and‑safety rules rank next. Variable shift premiums, piece‑rate pay, and informal overtime in agriculture and food service create frequent mismatches between promised and actual wages. The largest individual fine in 2024—$365 750—hit a seafood processor for both record and wage violations.

How Non‑Compliance Hurts Workers & LMIAs

A ban can strip workers of status, derail permanent‑residence plans, and split families. Firms meanwhile face suspended LMIAs, frozen hiring pipelines, and even contract terminations: most federal and provincial RFPs now contain clauses permitting immediate cancellation or exclusion when a supplier lands on the public non‑compliance list. Losing a single multi‑year government agreement can dwarf any AMP, while disqualification from future tenders can shut out millions in revenue for up to ten years—delays and losses that compound well beyond the initial fine.

The Six‑Step Self‑Audit

Quarterly self‑audits aren’t merely housekeeping, they are the only fast, reliable proof your HR team can present when inspectors give just 30 days’ notice. Conducting them every three months creates a time‑stamped trail of diligence that can slash fines, preserve hiring timelines, and even keep critical government contracts from collapsing:

- Payroll check – Match three recent payslips to LMIA wages.

- Duties audit – Verify on‑site tasks match work‑permit conditions.

- Housing & safety – Inspect logs for agricultural or remote sites.

- Training review – Confirm anti‑abuse and labour‑law sessions are up‑to‑date.

- Digital archive – Store contracts, payslips, and recruiter invoices securely.

- Audit memo – Log findings, fixes, and management sign‑off.

Corrective Action & Voluntary Disclosure

If gaps surface, act fast: repay wages, fix housing, retrain staff, and document everything. Last year, officials processed 5 465 worker tips—41 % sparked or fed inspections.

Submitting a voluntary disclosure before inspection can trim fines. Officers weigh completeness, timeliness, and impact on workers and the labour market. For multi‑province operations or abuse claims, retain a Regulated Canadian Immigration Consultant or employment lawyer to keep discussions privileged and negotiate remedial terms.

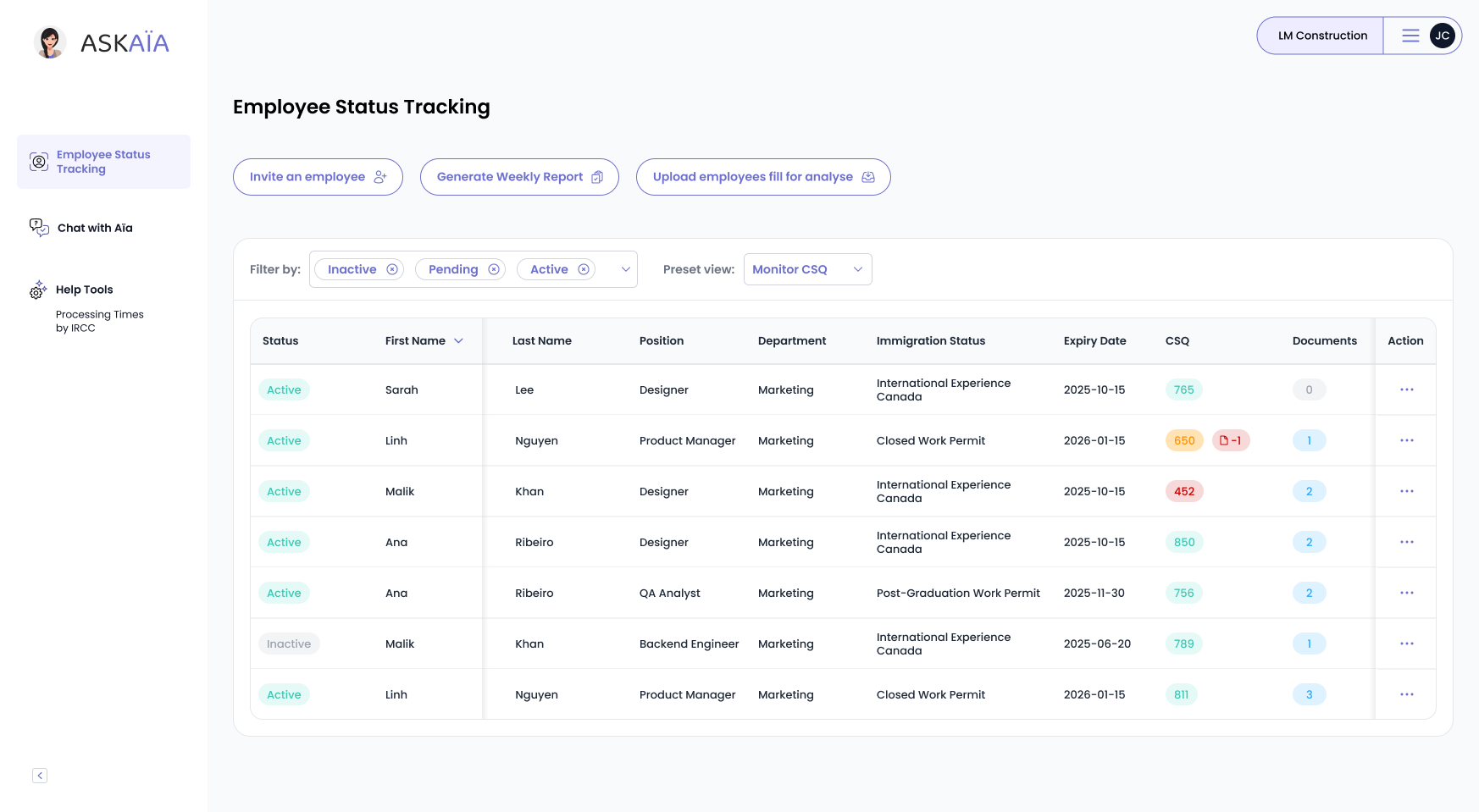

Take Action Today

Even reputable, well-resourced employers have faced penalties for preventable mistakes. The best defense is readiness. Book a free immigration compliance call with the experts on our team.

Let’s get your demo started

Book a demo

You May Also Like

These Related Stories

Immigration Compliance in Quebec: HR Essentials to Avoid Costly Fines

Are you an HR, payroll or compliance leader at a Quebec SME? If you already employ, or plan to hire, foreign workers, this session could save you hund …

Why Employers End Up on Canada’s Non-Compliance List

Every year, dozens of Canadian employers find themselves publicly listed as non-compliant with the Temporary Foreign Worker Program (TFWP) or the Inte …

Canada Extends Ukrainian Immigration Measures Until 2026 – Key Updates

On February 27, 2025, Canada extended key immigration measures for Ukrainians fleeing the war until March 31, 2026. Marc Miller announced that those w …