Every year, dozens of Canadian employers find themselves publicly listed as non-compliant with the Temporary Foreign Worker Program (TFWP) or the International Mobility Program (IMP). Whether you run a trucking fleet, a construction site, or a care home, compliance failures can stop your workforce instantly and damage your reputation

In this article, you will learn why employers are added to this list, what the main compliance failures are, and what you can do to avoid ending up there yourself.

What you will find in this article

What Is the Non-Compliance List?

The Government of Canada Non-Compliance List is an official public registry of employers who have violated TFWP or IMP requirements. Employers who appear on this list face serious consequences, including fines of up to $1 million cumulatively, suspensions from hiring foreign workers, and public naming.

According to Immigration, Refugees and Citizenship Canada (IRCC), over 270 employers have been listed since the registry was created, reflecting a steady increase in enforcement actions.

Top 5 Reasons Employers Are Listed

Government inspections and audits consistently identify five recurring issues that result in employers being deemed non-compliant:

1. Inadequate Record-Keeping

Employers must keep complete records for at least six years, including recruitment documents, wage statements, and proof of working conditions. Missing or incomplete records are among the most frequent violations cited during audits.

2. Non-Equivalent Wages or Working Conditions

By law, temporary foreign workers must receive the same wages and working conditions as Canadians in similar positions. Any deviation, whether intentional or accidental, can result in substantial penalties.

3. Failure to Provide Employment

Some employers obtain work permits but do not actually offer employment as promised. In 2023, several companies were fined for failing to provide any work after workers arrived, triggering ineligibility to hire foreign workers for up to five years.

4. Misrepresentation in Applications

Submitting false or misleading information in a Labour Market Impact Assessment (LMIA) or work permit application is considered a serious offence. This includes overstating job offers, misclassifying positions, or concealing wage practices.

5. Obstructing an Inspection

Refusing to cooperate with inspectors, failing to respond to requests, or deliberately destroying records will immediately trigger enforcement action and inclusion on the non-compliance list.

Enforcement in Numbers: A Growing Trend

Compliance enforcement has expanded significantly:

- In the past five years, fines have increased by over 55%

- Over $2.4 million in penalties were issued to trucking companies alone

- In 2024, inspections reached a record high, reflecting the government’s commitment to stricter oversight

Imagine receiving an unexpected inspection notice and realizing that missing payroll records or inconsistent contracts could result in the suspension of your entire foreign workforce within weeks. For many HR managers, this scenario isn’t hypothetical; it’s a reality that can result in hundreds of thousands of dollars in fines and irreparable brand damage.

Comparison: Common Violations and Penalties

| Violation Type | Potential Fine (per infraction) | Ineligibility Period |

| Inadequate Record-Keeping | Up to $100,000 | Up to 2 years |

| Non-Equivalent Wages/Conditions | Up to $100,000 | Up to 2 years |

| Failure to Provide Employment | Up to $100,000 | Up to 5 years |

| Misrepresentation in Applications | Up to $100,000 | Up to 10 years |

| Obstructing an Inspection | Up to $100,000 | Up to 10 years |

Source: IRCC Compliance Guidelines

Real Examples of Enforcement

Recent cases illustrate the risk:

- Seafood Company (Atlantic Canada): Fined for failing to provide employment after LMIA approval.

- Trucking Firms (British Columbia): Penalized over wage discrepancies and record issues.

- Construction Businesses (Ontario): Suspended from the TFW Program due to missing contracts and payment records.

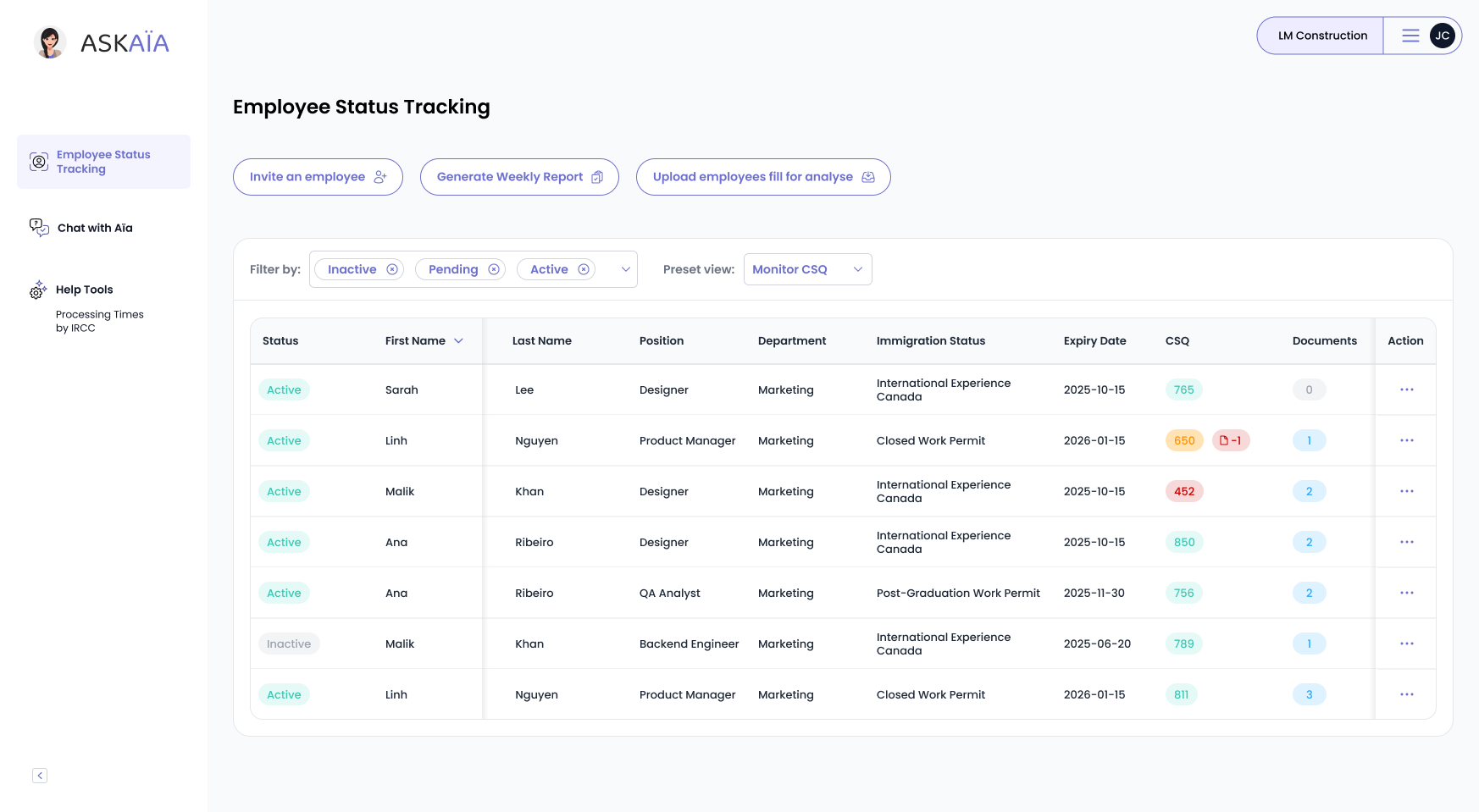

How to Check If You’re at Risk

Employers can review the official list to confirm their status. Proactive compliance measures, including periodic internal audits, comprehensive record-keeping, and documented HR policies, are essential.

Self-assessment questions you should consider:

- Are all employment records up to date and stored securely?

- Do wages align with prevailing rates for the occupation?

- Is your LMIA or work permit information fully accurate?

- Would your HR team be prepared for a random inspection?

Next Steps to Protect Your Business

Non-compliance isn’t just a legal issue; it can disrupt operations, damage your brand, and hinder your ability to meet staffing needs. In upcoming articles, we will explore:

- How to prepare for inspections

- How to correct compliance gaps

- How to implement best practices that protect your organization

Take Action Today

Not sure whether your compliance processes meet the latest standards? Book a free immigration compliance consult with the experts on our team.

Let’s get your demo started

Book a demo

You May Also Like

These Related Stories

How to Stay in Canada After Graduation: PGWP Rules Explained by Bani

Thinking of staying in Canada after graduation? For many international students, the Post-Graduation Work Permit (PGWP) is the first step toward build …

Act Fast: Canada Delays PGWP Program Removal to Early 2026

At a Glance " \n Canada postponed the removal of 178 study programs from PGWP eligibility to early 2026. \n This gives students extra time to graduate …

Change Jobs Faster: Canada’s New Policy Lets TFWs Switch Employers

Temporary foreign workers (TFWs) often face delays when switching employers in Canada. A new IRCC policy now allows eligible workers to start new jobs …