30 days to a stress-free immigration audit

1 in 10 companies is sanctioned for non-compliance in the management of its foreign workers, and the fine can reach $1 million. In this context, being prepared for an inspection is no longer an option: it's survival insurance for your organization.Every inspection aims to verify that employers comply with the rules surrounding the hiring and management of foreign workers: wages, conditions, documentation, rights. Yet the majority of sanctions are the result of avoidable errors: incomplete files, untraceable evidence, lack of traceability.

This practical guide explains how to prepare your organization in 30 days, in four simple sprints, to achieve compliance at all times: diagnosis, corrections, documentation and simulation. The aim: to reduce your risks, protect your teams and turn compliance from an administrative chore into a genuine strategic advantage for your company.

Au sommaire de ce guide

- Why immigration compliance will be critical in 2025

- Understanding the new rules and their impact

- What inspectors check - and why it matters

- The 5 most costly common mistakes

- The 30-day plan for 24/7 compliance

- Week 1 - Express diagnosis & evidence gathering

- Week 2 - Correct, align and prevent deviations

- Week 3 - Preparing the audit file and testing its robustness

- Week 4 - Maintain compliance and stay one step ahead

- Measuring the ROI of compliance tools (HR + Finance)

Why immigration compliance will be critical in 2025

Canadian authorities have stepped up audits related to the hiring and management of foreign workers. In 2024-2025, 1,435 audits were conducted, 10% of employers were sanctioned, and penalties totaled nearly $4.9 million, some as high as $1 million. These figures show that no company is immune.

Today, being ready for an immigration audit is no longer a formality: it's a question of business continuity. Sanctions can suspend hiring capacity, curb production and damage public reputation, since offending companies are included on an official list accessible to all.

In this context, aiming for compliance at all times means going beyond simply reacting to inspections. It means building a system capable of proving, at any time, that every file is complete, compliant and traceable. In other words: preparing for an immigration audit in 30 days is not just a preventive strategy, it's the best way to ensure a stress-free immigration audit and protect your organization for the long term.

Understanding the new rules and their impact

Since 2024, Ottawa has tightened oversight of employers who hire foreign workers. Inspections are more frequent, faster and more demanding. A simple documentary error can lead to a fine of several thousand dollars or a temporary hiring ban.

To avoid these consequences, companies must prove that they comply with every requirement: wages, working conditions, housing, and workers' rights. Only 24/7 compliance - based on up-to-date, centralized evidence - can reduce risk and ensure business continuity, even during a stress-free immigration audit.

What inspectors check - and why it matters

During an immigration audit, inspectors examine whether the reality of the work corresponds to what was promised: tasks, wages, hours, accommodation and compliance with the law. Their aim: to protect workers and spot abuses.

A misfiled file, an incomplete payslip or a non-compliant contract are enough to trigger a sanction. Being ready for an immigration audit means being able to prove, at all times, that every document is accurate, dated and traceable, an essential basis for compliance at all times.

The 5 most costly common mistakes

- Documents not found or submitted late (non-production during inspection).

- Wage/condition discrepancy vs. LMIA offer.

- Failure to provide an abuse-free environment.

- Inaccuracies in LMIA application.

- Non-cooperation (absence from inspection, failure to respond).

The 30-day plan for 24/7 compliance

Becoming ready for an immigration audit doesn't happen overnight, but a month is all it takes to build a solid foundation. In just four weeks, a company can move from scattered management to around-the-clock compliance:

- Week 1 : make a diagnosis, identify discrepancies and centralize key documents.

- Week 2: correct discrepancies in wages or conditions and formalize anti-abuse policies.

- Week 3: compile audit file and test ability to produce evidence quickly.

- Week 4: validate governance, review suppliers and simulate a stress-free immigration audit.

This structured process helps HR to regain control, reduce risk and demonstrate, with evidence in hand, the rigor of their compliance.

Week 1 - Express diagnosis & evidence gathering

The first step towards compliance at all times: knowing where you really stand. This week, the aim is to get a clear view of risks, gaps and document quality before any audit.

1. Map your foreign workers

- List each international employee: status, type of permit, expiry dates, location, supervisor.

- Check the correspondence between job offers, actual tasks and working conditions.

2. Examine salaries and conditions

- Compare pay slips, hours worked and benefits with original commitments.

- Identify any undeclared variations and record any corrections to be made.

3. Gather key evidence

- Centralize contracts, LMIAs, proof of recruitment, anti-abuse policies and training receipts.

- Organize documents by employee and site, with a designated person responsible for each file.

4. Create a document safe

- Consolidate everything in a secure space with history and limited access.

- Be prepared to provide a supporting document in less than 24 hours: it's the basis for a stress-free immigration audit.

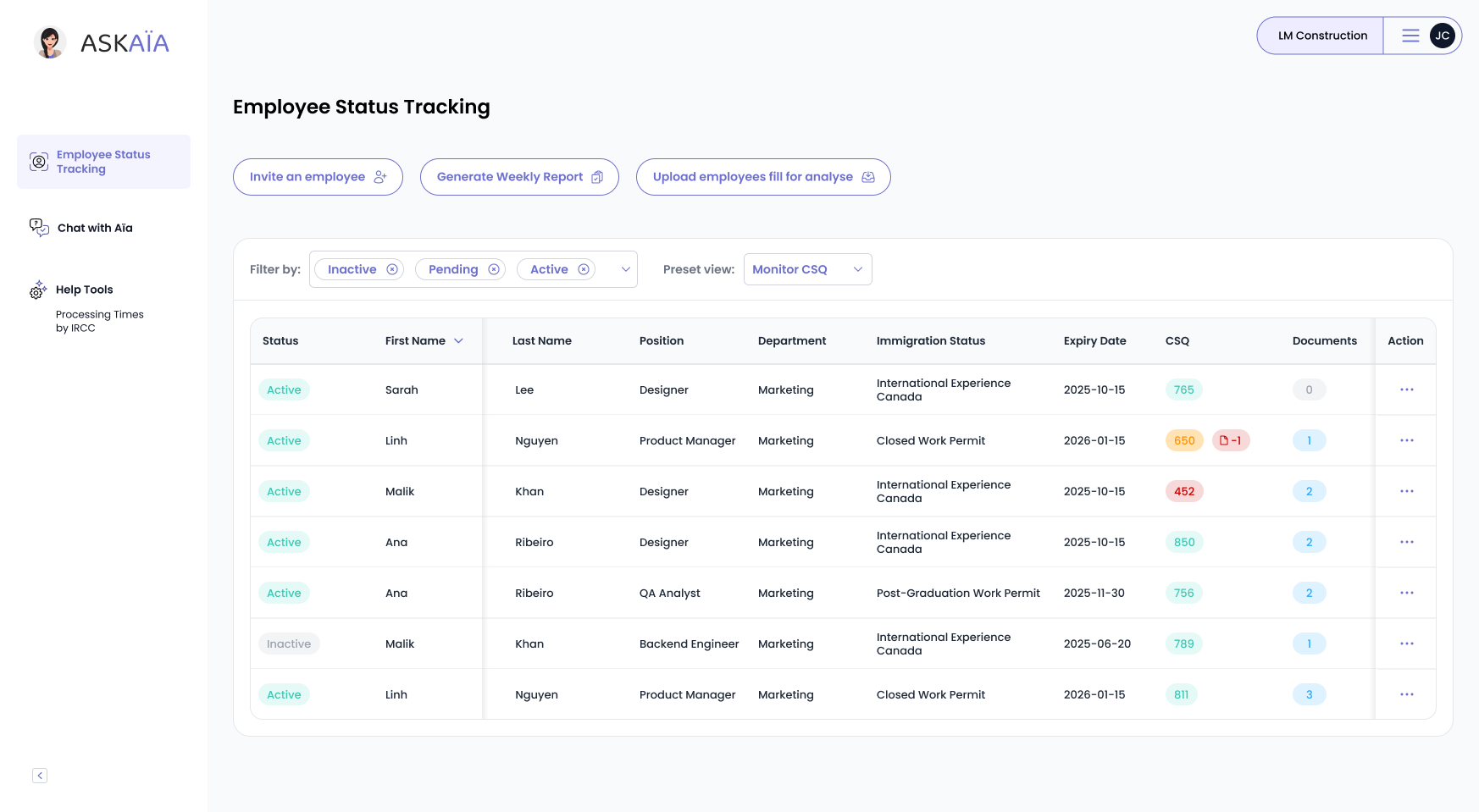

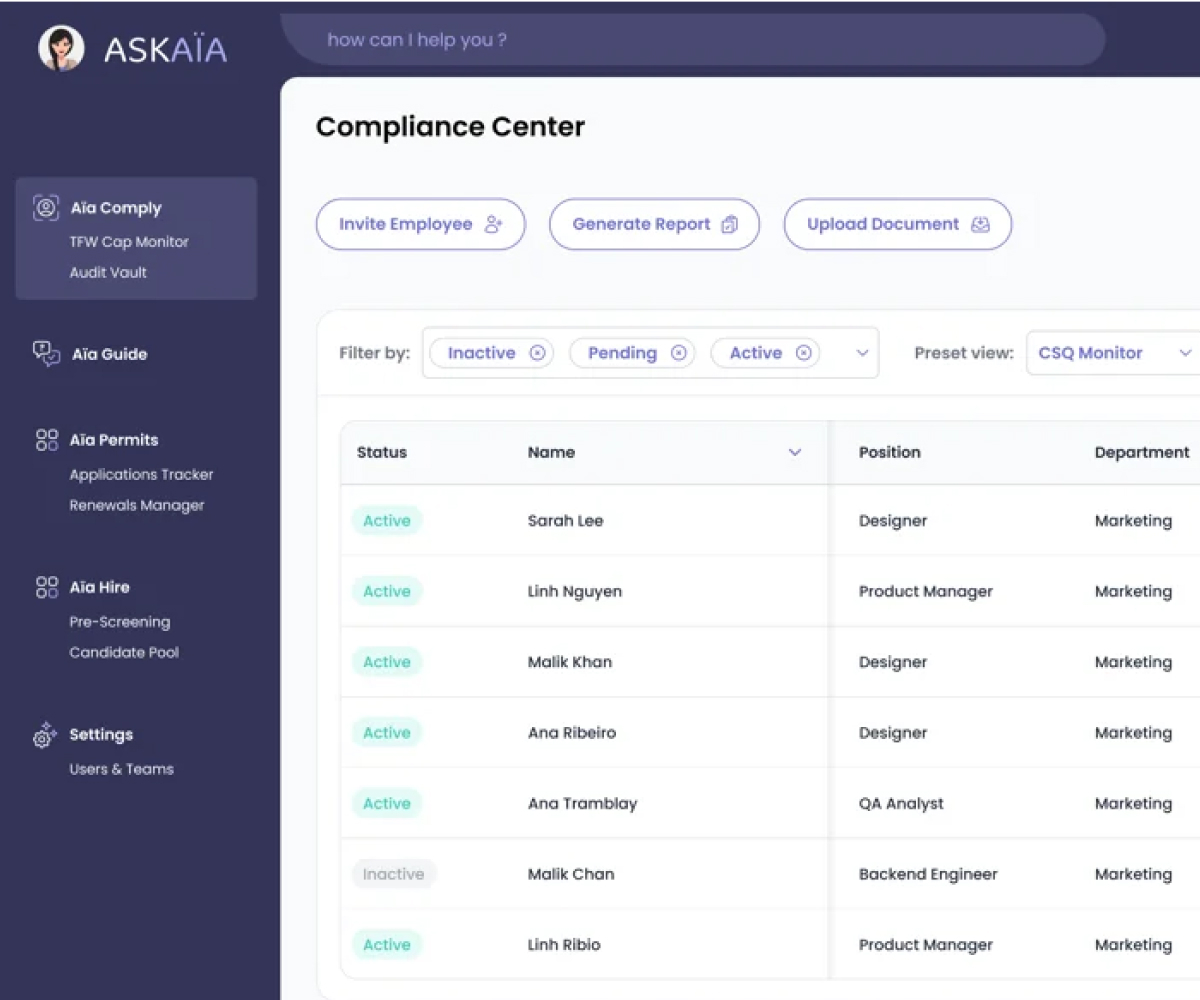

With a tool like Aïa Comply, this step becomes simple: automated data import, deadline reminders and compliance register generation. In just a few days, your evidence is centralized and your risks visible, the first step towards a successful immigration audit.

Week 2 - Correct, align and prevent deviations

The aim of this second stage is to move from observation to action. Once deviations have been identified, they need to be corrected, documented and practices put in place to prevent their recurrence. The aim is to reinforce compliance at all times, before it is tested by an inspection.

1. Correct wage and contract discrepancies

- Compare wages paid with those promised in validated bids.

- Immediately adjust any discrepancies and archive proof (corrected pay slips, contract addenda).

- Note the reasons for adjustments to demonstrate transparency in the event of an audit.

2. Update internal policies

- Check that your anti-abuse and equal treatment policies are written, accessible and applied.

- Provide rapid training for managers and post internal recourse procedures for workers.

3. Consolidate communication with foreign employees

- Provide the official workers' rights leaflet in the appropriate language.

- Document delivery and acknowledgement of receipt.

4. Prevent future deviations

- Set up an alert system for permit renewals, job or site changes.

- Automate monthly compliance reminders, the key to a stress-free immigration audit.

With Aïa Comply, these steps are simplified: automatic alerts, tracking of corrections and an audit vault updated in real time. By the end of week 2, your company will have more than halved its risk exposure and laid the foundations for sustainable compliance.

Week 3 - Preparing the audit file and testing its robustness

This week marks the transition to proof: the aim is to be able to demonstrate, without delay, your compliance at all times.

1. Put together a complete audit file

- Gather the essential elements: signed contracts, decision letters, proof of pay, training certificates, communications with authorities.

- Check that each document is dated, legible and linked to the right person or site.

2. Organize evidence for quick access

- Classify files by type and employee; create a clear index for each site.

- Prepare an "inspection" copy to share on request: this is the basis for a stress-free immigration audit.

3. Simulate an internal audit

- Run a 90-minute test: one HR manager plays the inspector, another the company.

- Evaluate: response time, consistency of documents, clarity of explanations.

4. Document corrections

- Any shortcomings identified should be corrected immediately, with a supporting note.

- In the event of an actual inspection, this proof of correction shows your good faith and reduces penalties.

Week 4 - Maintain compliance and stay one step ahead

The final week focuses on transforming the good reflexes you've acquired into lasting habits. The aim is to keep your organization ready for an immigration audit at any time, without relying on emergency mobilization.

1. Establish clear governance

- Assign responsibility for HR, payroll, operations and compliance.

- Set up a quarterly monitoring schedule and rapid file reviews.

2. Secure your external relations

- Regularly check your suppliers and partners against the public list of non-compliant employers.

- Include a contractual clause on compliance and collaboration in the event of an audit.

3. Maintain an active regulatory watch

4. Automate follow-up

- Centralize your data and use intelligent alerts to avoid oversights.

- A tool like Aïa Comply simplifies this monitoring: expiration alerts, monthly reports and audit exports are just a click away.

By the end of week 4, your company is compliant at all times. You move from a defensive approach to proactive management, able to get through an immigration audit stress-free, whatever the time or context.

Measuring the ROI of compliance tools (HR + Finance)

Investing in a compliance solution at all times is not a cost, it's a measurable saving. Companies exposed to an immigration audit risk up to $1 million in fines and hiring interruptions that can cripple operations. Conversely, a tool-based approach reduces these potential losses while improving HR productivity.

The cost of non-compliance is calculated as follows:

(potential fine + ban-related operating losses + reputational cost)

- cost of compliance (HR time, salary adjustments, tools)

Indicators to monitor :

- Rate of deviations corrected / deviations detected (rolling 90 days)

- Average proof production time (SLA)

- Payroll/time compliance rate vs. offer

- Percentage of employees having received rights information + anti-abuse training

- % of suppliers screened (verified vs. total active)

Compare the annual cost of a tool like Aïa Comply with the average cost of non-compliance: loss of access to the program, legal fees, lost hours and damage to reputation. In general, the return on investment is achieved as soon as the first inspection is avoided.

In short, tool-based compliance is not an expense item: it's a cost-effective prevention strategy and a clear signal of operational maturity for any organization employing foreign talent.

Let’s get your demo started

Book a demo

You May Also Like

These Related Stories

Top Compliance Risks in Key Canadian Industries

Compliance failures don’t look the same in every sector. From trucking fleets to healthcare providers, each industry faces unique vulnerabilities that …

Aïa Comply - Canada's new HR compliance standard

Each compliance error is costly, with fines of up to $100,000 and thousands of lost HR hours. After analyzing over 5,000 real-life cases and 100 HR in …

Master LMIA Compliance: Best Practices for Policies and Record-Keeping

For Canadian employers, LMIA compliance is far more than securing initial approvals, it’s an ongoing obligation rooted in clear policies and rigorous …