Ditch Spreadsheets: Why Compliance Tech Is Now Critical in Canada

Canadian employers are under growing scrutiny as immigration audits surge and documentation rules tighten. Old-school compliance methods, like Excel and PDFs, can no longer keep up.

This article breaks down why spreadsheet tracking fails, how digital compliance tools reduce risks, and what data shows about audit outcomes, penalties, and inspection trends. It also explores sector-specific complexities, recent government enforcement activity, and the cost implications of non-compliance.

At a Glance

- Nearly half of compliant employers in 2022–2023 had to justify or correct records to avoid penalties.

- Manual tools like Excel often miss audit triggers—such as permit expiries or wage mismatches.

- Quebec’s added rules on language, wage, and CAQ make manual tracking even riskier for employers.

Context – Immigration Compliance Pressure Is Climbing

Recent enforcement trends reveal that federal audits under the Temporary Foreign Worker Program (TFWP) are more aggressive than ever. Between April and September 2024, Employment and Social Development Canada (ESDC) conducted 649 inspections.

- $2.1 million in fines were issued in just 6 months, an increase of 31% compared to the same period in 2023.

- 20 employers were banned, a fivefold increase over the same period in 2023.

- The failure rate was 11%, but even "compliant" employers often had to make corrections to avoid penalties.

Over the full 2022–2023 fiscal year, more than 2,100 inspections were conducted. Although 95% of employers were deemed compliant, nearly half only achieved that status after being asked to justify or remediate deficiencies.

These outcomes highlight that the threshold for what counts as "compliance" is tightening, and that proving it requires clear, linked documentation that DIY systems often lack. This reality is especially acute for employers managing larger workforces across multiple job locations or sectors like agriculture, construction, or care services.

The Hidden Risks of Spreadsheets in LMIA Compliance

Manual tracking remains common: Excel spreadsheets, Word files, and email chains. Yet these tools are vulnerable in ways that audit standards no longer tolerate.

Top three spreadsheet pitfalls:

Fragmented Data:

- LMIA proofs (ads, job offers, housing agreements) are stored in separate files.

- During audits, employers often struggle to cross-reference documents quickly.

Version Errors & Access Gaps:

- Without audit trails or user controls, outdated versions circulate unchecked.

- Files are often overwritten, misnamed, or stored on personal drives.

No Alert Systems:

- Manual tracking fails to flag expiry dates for work permits, wage updates, or LMIA renewals.

- A missed deadline can trigger an automatic non-compliance finding.

Case Snapshot: In 2023, an Ontario construction firm failed an inspection after it couldn’t provide proof of housing for a temporary worker. The record had been saved under an incorrect file name and wasn't accessible to the HR lead during the audit. The company was fined $5,000 and temporarily suspended from hiring under the TFWP.

These issues are compounded in high-turnover or multilingual environments, where records often pass through multiple hands and departments, increasing the risk of inconsistencies and misplaced documentation.

What the Data Says: Manual vs. Tech-Driven Compliance

| Feature | Manual Tracking (Excel) | Compliance Tech Tools |

| Version Control | Risk of overwrites | Secure audit trail |

| Deadline Alerts | Manual calendar input | Automated reminders |

| Document Linking (LMIA ↔ Payroll) | Disconnected files | Cross-referenced uploads |

| Multi-user Access | Prone to error | Role-based permissions |

| Audit Readiness | Time-consuming search | Instant document exports |

Employers using structured digital systems are more likely to pass inspections without conditions. According to 2022–2023 compliance summaries:

- 95% of employers audited were found compliant, but over 40% had to justify or remediate violations to get there (canada.ca).

- Over $1.6 million in administrative monetary penalties were imposed in 2022–2023, according to official ESDC summaries, often for "paperwork lapses" like missing wage evidence or incomplete job ads.

- Audits can request any LMIA-related file, and employers must provide the documents promptly upon receiving the notice, and employers must retain this documentation for 6 years (IRPR s.209.2–209.9).

The cost of falling short goes beyond the audit room. Public-sector contracts often include immigration compliance clauses. Failure to comply can result in disqualification from tenders or cancellation of existing agreements.

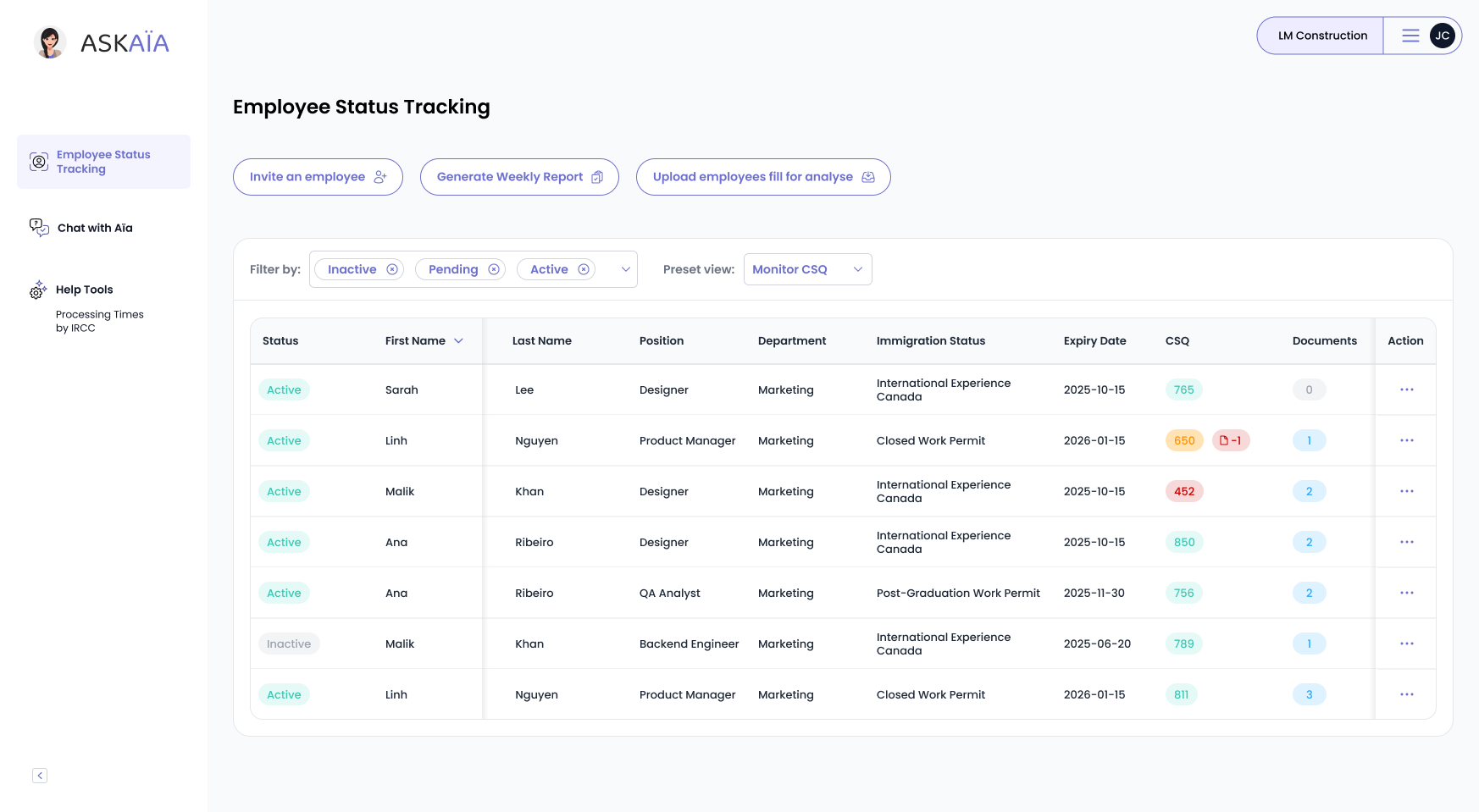

Compliance Tech: Features That Prevent Penalties

Modern immigration compliance tools address the very gaps spreadsheets expose. They provide:

- Centralized Record Systems. All LMIA, payroll, housing, and offer files are linked and searchable in one place.

- Automated Alerts. Get notified of permit expiries, job ad lapses, and wage review deadlines.

- Audit-Ready Archiving. Time-stamped documents with version history and download logs meet the strictest IRCC/ESDC criteria.

These platforms also offer exportable audit kits and document checklists aligned with Service Canada's inspection requirements. Some even integrate with payroll systems, ensuring that TFW salaries match approved wages and pay periods without manual checks.

Why Waiting Costs More Than Switching

For Quebec employers, compliance is even more complex due to CAQ rules, French-language offer requirements, and provincial wage thresholds, all of which compound the risk when tracking manually.

Even if fines seem avoidable, other costs quickly escalate:

| Risk Type | Description |

| Financial Penalties | Fines range from $500 to $100,000 per violation (ESDC). |

| Hiring Bans | Suspension from TFWP can last 1–2 years, crippling talent acquisition. |

| Lost Contracts | Non-compliance can void public and private procurement deals. |

| Reputational Harm | Names are listed on ESDC’s public “non-compliant employer” registry. |

Employers relying on old systems often realize too late that an incomplete payroll log or a missing document can cascade into six-figure losses and irreparable brand damage.

Recommendations: Transitioning from DIY to Digital

- Self-Audit: Use our free 6-step checklist to identify documentation or process gaps.

- Prioritize High-Risk Records: Focus on housing, payroll, wage, and LMIA offer documentation first.

- Pilot a Compliance Dashboard: Test a tool that centralizes access, flags risks, and reduces manual workload.

- Engage Cross-Functional Teams: Include HR, legal, and payroll stakeholders to ensure smooth data integration and ownership.

- Track Metrics: Monitor audit prep time, documentation completeness, and incident frequency to measure ROI.

Take Action Today

Even reputable, well-resourced employers have faced penalties for preventable mistakes. The best defense is readiness. Book a free immigration compliance call with the experts on our team.

Let’s get your demo started

Book a demo

You May Also Like

These Related Stories

Top Compliance Risks in Key Canadian Industries

Compliance failures don’t look the same in every sector. From trucking fleets to healthcare providers, each industry faces unique vulnerabilities that …

Why Employers End Up on Canada’s Non-Compliance List

Every year, dozens of Canadian employers find themselves publicly listed as non-compliant with the Temporary Foreign Worker Program (TFWP) or the Inte …

Immigrants Get 75 Days to Challenge Visa and PR Rejections

Canada just gave immigrants more time to appeal denied applications. This article explains the new 75-day deadline for judicial reviews and its impact …