Getting an LMIA approved is a win, but it’s not the finish line. For HR teams, the true compliance challenge begins after the foreign worker is hired. As of 2025, penalties for post-approval violations have doubled, and Service Canada is expanding audits on employers years after the LMIA decision.

In this article, we explain what your company must do after receiving a positive LMIA, what to document, how long to keep it, and what triggers inspections.

What you will find in this article

- LMIA Approval Is Just the Start

- Post-LMIA Employer Obligations

- The 6-Year Rule: What You Must Keep on File

- What Triggers a Compliance Audit?

- Penalties and Public Exposure

- Common HR Gaps in LMIA Compliance

- How to Stay Audit-Ready

- Quick Checklist: Is Your LMIA File Audit-Ready?

- LMIA Compliance Is a Long Game

LMIA Approval Is Just the Start

Once your LMIA is approved and your foreign hire starts working, your obligations as an employer shift into long-term compliance mode.

Service Canada may conduct random or targeted inspections at any time in the 6 years following employment. If you can’t provide proof of compliance, you risk:

- Fines of up to $100,000 per violation

- Temporary or permanent bans from the LMIA program

- Public listing as a non-compliant employer

Post-LMIA Employer Obligations

You must ensure the worker:

- Is paid the wage stated in your LMIA

- Performs the duties listed in the application

- Works the hours and schedule promised

- Receives benefits and housing (if applicable) as stated

- Is not moved between locations or roles without prior authorization

The 6-Year Rule: What You Must Keep on File

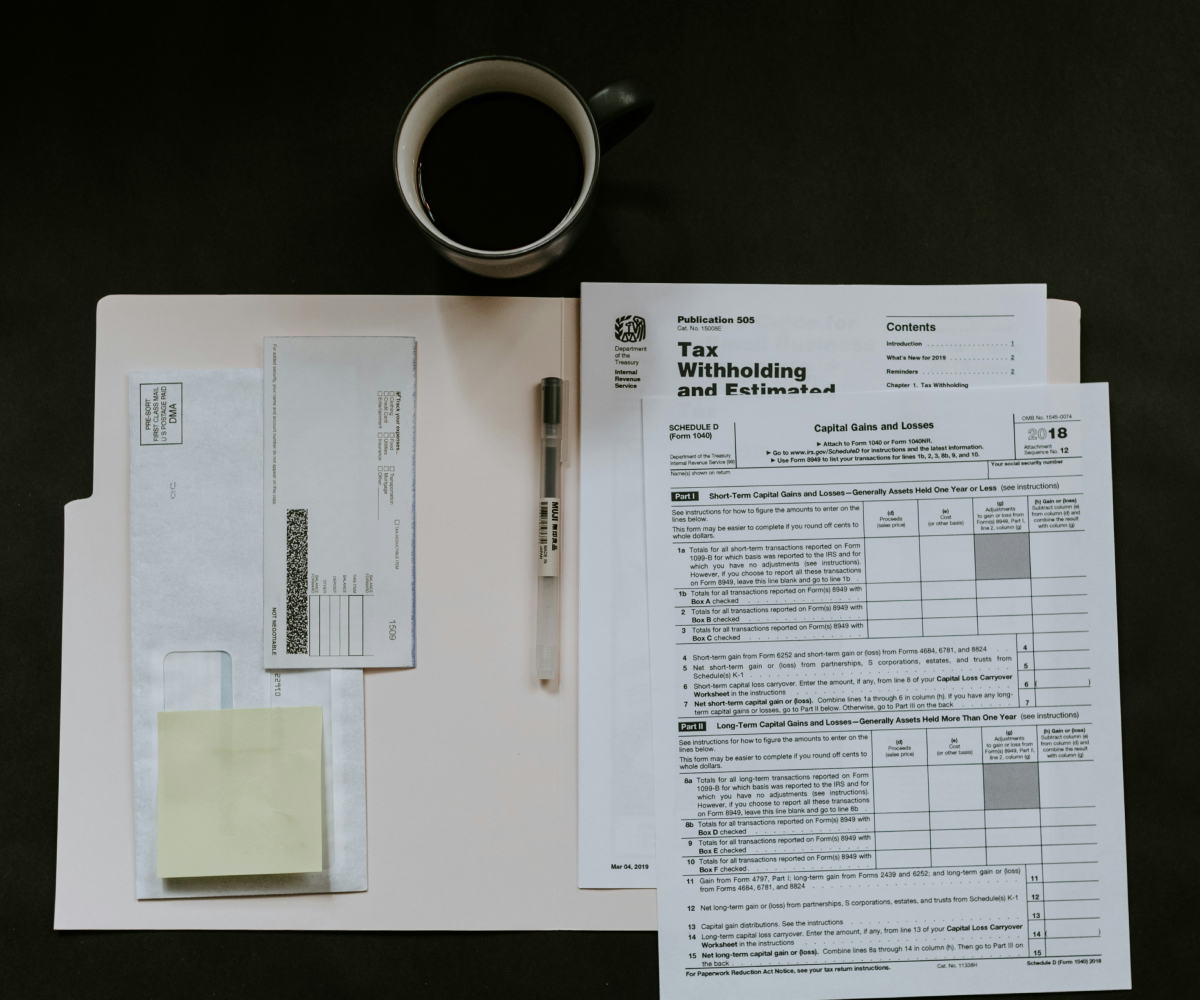

By law, employers must retain all records for 6 years from the first day of employment. This includes:

- LMIA decision letter & application package

- Employment contract & signed offer

- Time sheets & schedules

- Wage payment records (pay stubs, bank proof)

- Tax remittances & T4s

- Proof of benefits or housing (if applicable)

- Recruitment records and job postings

Service Canada may request these at any time, even years after the worker has left.

What Triggers a Compliance Audit?

Your company may be selected for inspection if:

- The worker files a complaint

- You apply for multiple LMIAs in the same role

- You're in a high-risk sector (e.g., retail, construction, agriculture)

- Your file has inconsistencies (e.g., salary below market rate)

Penalties and Public Exposure

The consequences of non-compliance are serious and long-lasting:

| Violation | Potential Penalty |

| Underpaying wages | Up to $100,000 fine + repayment |

| Missing records (e.g. hours worked) | Monetary penalty + audit flag for future LMIAs |

| Changing job duties without notice | Program suspension for up to 5 years |

| Repeated violations | Permanent ban + public blacklisting on Canada.ca |

Once listed publicly, it becomes harder to hire foreign workers, even in other programs.

Common HR Gaps in LMIA Compliance

Even well-organized HR departments often fall short in areas like:

- Fragmented file storage across different systems or folders

- Staff turnover, leading to undocumented processes or missing case knowledge

- Inconsistent record retention between payroll, HR, and operations

- Untracked changes in roles, wages, or job locations during the worker’s stay

Tip: Use a shared compliance checklist across your HRIS, payroll, and immigration teams to stay aligned.

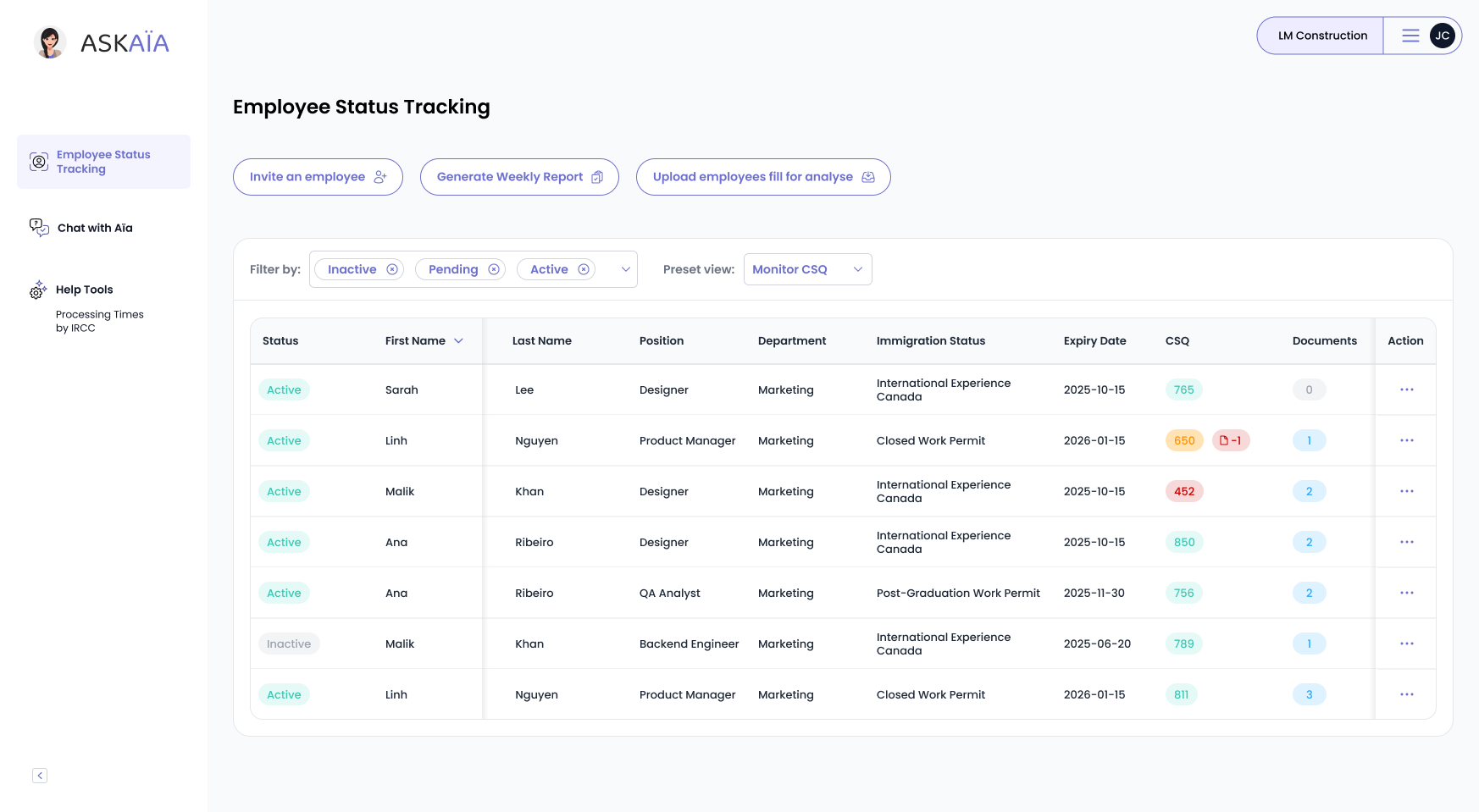

How to Stay Audit-Ready

HR teams should:

- Use centralized HR systems to store LMIA files

- Conduct internal compliance audits annually

- Keep payroll, time-tracking, and job descriptions synced

- Work with immigration advisors to update LMIAs when changes occur

Quick Checklist: Is Your LMIA File Audit-Ready?

- Job ads and recruitment proof saved with timestamps

- Contract and duties match the LMIA application

- Wage, hours, and schedule records are up to date

- Changes in location or role are reflected in permits

- Payroll and tax records are accessible and synced

- All documentation retained for 6 years by employee name

LMIA Compliance Is a Long Game

Your responsibility doesn’t end when the LMIA is approved, it continues for 6 years. The best way to stay safe is to treat LMIA compliance like a long-term legal obligation, not just an immigration step.

Not sure if your file would pass an audit? Book a free consultation with our team to plan your next hire.

Let’s get your demo started

Book a demo

You May Also Like

These Related Stories

LMIA File Prep 2025: Documents, Proof & Transition Plans Explained

Posting the job is only half the LMIA battle. For HR teams, most rejections happen when the file is incomplete: missing documents, vague transition pl …

LMIA Streams 2025: Pick High-Wage, Low-Wage, or GTS Fast

Canada’s LMIA system now operates at two speeds: eight-day approvals for Global Talent Stream roles and months-long queues or outright freezes for man …

LMIA: Can you get a work permit? All Your Questions Answered

Many newcomers struggle with securing a job in Canada due to Labour Market Impact Assessment (LMIA) complexities. Who qualifies? How do you apply? Wha …