Québec Employer Checklist: Essential CNESST & MIFI Compliance Steps

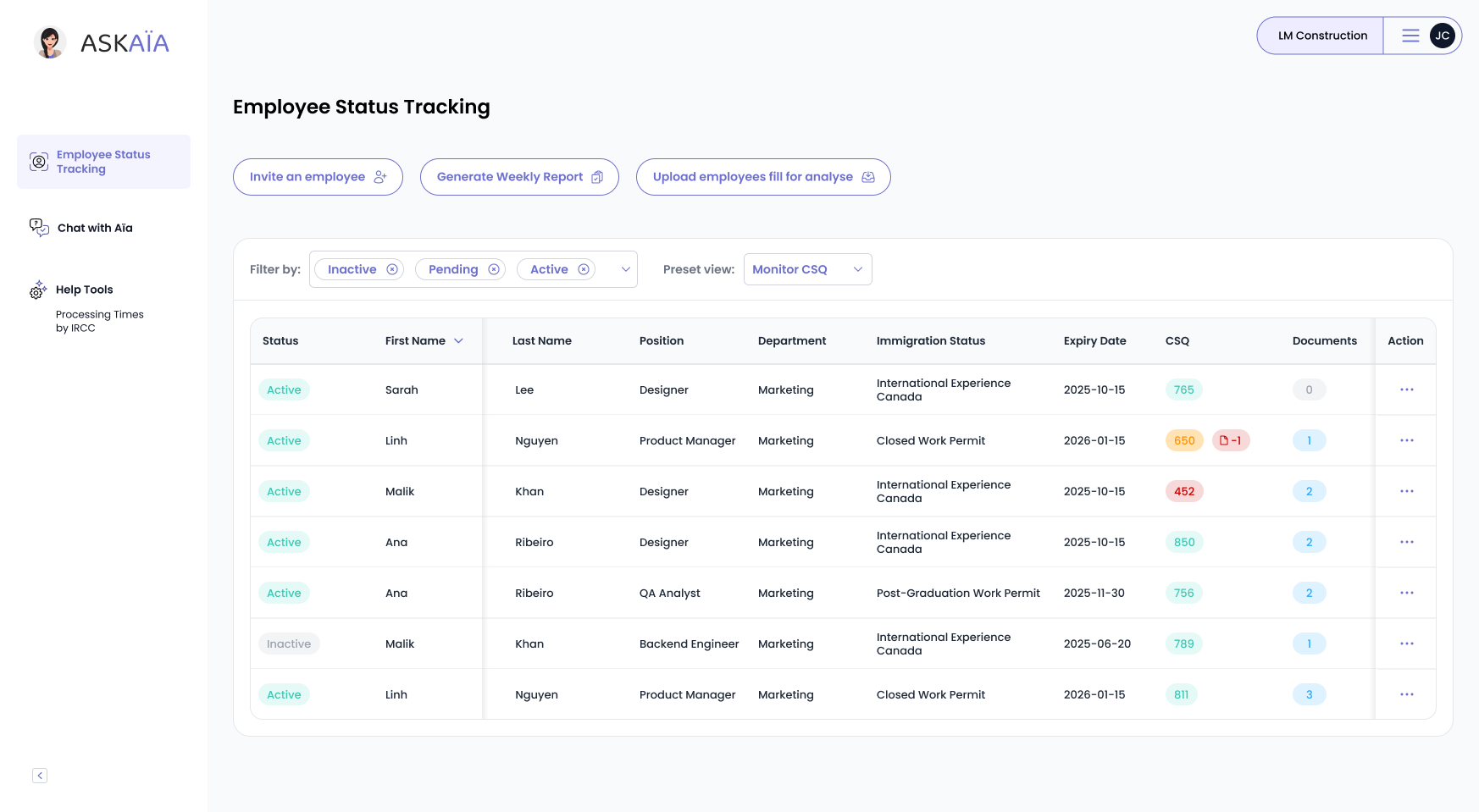

Québec blends its own labour standards regime with Ottawa’s federal inspections, forcing employers to juggle CAQs, LMIAs, and CNESST audits. One sloppy file can spark dual fines, worker‑status loss, and costly production delays that ripple through entire supply chains. With enforcement activity up sharply since 2022 and penalty ceilings rising every budget cycle, HR leaders need a panoramic view of how federal and provincial pieces fit together.

This guide decrypts 2025’s biggest provincial changes, shrinking Simplified‑LMIA lists, low‑wage moratoriums, six‑year record demands, and contrasts them with federal rules and timelines. Drawing on the latest figures from Service Canada, MIFI, and CNESST, we layer verified data with practical actions so you can keep talent moving while regulators intensify their spotlight.

At a Glance

- 76 occupations remain on Québec’s facilitated LMIA list after a dramatic 72 % cut on 24 Feb 2025.

- 2 100 employer inspections in 2022‑23 produced $1.6 M in federal fines and 7 bans—before CNESST interest and surcharges.

- The low‑wage LMIA moratorium now blankets CMAs containing 65 % of Québec job vacancies, pushing processing to 53 working days.

Context — Québec’s Dual‑Regulator Maze

Every foreign worker in Québec triggers at least three government touch‑points—federal Service Canada (LMIA), provincial MIFI (CAQ) and CNESST (labour/OHS). The matrix below illustrates where accountability sits and pinpoints the most common hand‑off failures.

| Compliance Stage | Federal (ESDC/IRCC) — Key Duties & Benchmarks | Québec (MIFI + CNESST) — Added Layer |

| Job offer & advertising | High‑/Low‑/GTS LMIA ads; proof kept 6 yrs; 10 % low‑wage cap; CMA unemployment ban kicks in ≥ 6 % (July 2025 update) | Facilitated ("traitement simplifié") list cut to 76 occupations on 24 Feb 2025; no ads but French contract required |

| LMIA/CAQ filing | Online LMIA portal; service standards 7–53 working days depending on stream (SC dashboard Aug 2024) | Dual submission: CAQ (form A‑0506‑CA) + provincial LMIA annex; OHS premiums prepaid to CNESST |

| Work permit issuance | IRCC issues permit once LMIA + CAQ cleared; biometrics & med exams add 5–8 working days | MIFI silent here, but CAQ renewal must shadow work‑permit expiry; approx. 22 000 CAQ renewals processed in 2024 ([quebec.ca] statistics) |

| Ongoing records | 6‑year audit window; 48‑hour doc turnaround (IRPR 209.7) | 6‑year French‑language record retention; annual wage statement to CNESST by 15 Mar; late filing interest prime + 3 % |

Why it matters: A single TFW file may be “green‑lit” federally yet fail provincially if the French contract or CNESST wage statement is missing, creating an invisible compliance gap that surfaces only during inspection.

Major Compliance Pitfalls in 2025

Below are the five issues most often cited by auditors in the past two fiscal years. Tackling them early eliminates over 80 % of notice‑of‑violation triggers, according to CNESST’s 2024 enforcement bulletin.

- Shrinking Facilitated LMIA List — List down 72 % to 76 occupations; loss of TEER 0 managers means firms now face full ads and prevailing‑wage proofs ([quebec.ca]).

- Low‑Wage Moratoriums — New refusals if a site surpasses 10 % low‑wage TFWs and is located in a CMA with unemployment ≥ 6 %—affecting Montréal, Gatineau, Sherbrooke, Trois‑Rivières, among others (ESDC chart, July 2025). Combined, these CMAs house 65 % of Québec’s job vacancies.

- Six‑Year Record Requirement — IRPR 209.8 and CNESST Act both allow retroactive document demands up to six years; missing French contracts or payroll slips drew 312 warnings in 2023‑24.

- Late Wage Statement Penalties — $25/day (min $25, max $2 500) after 15 Mar filing deadline; interest applied monthly at average 8.2 % APR in 2024 (CNESST finance report).

- Audit Surge — 2 100 employer inspections in 2022‑23 (+18 % YoY); failure rate 5 % but monetary penalties jumped 31 % to $2.1 M and bans rose to 7, including two Québec manufacturers (ESDC Results Report 2023).

Taken together, these pitfalls prove compliance is no longer paperwork—miss just one and hiring can stall for quarters, draining budgets and undermining worker confidence.

Processing‑Time & Stream Comparison (mid‑2025)

Use the table to match hiring urgency with realistic lead times and cost commitments.

| LMIA Stream | Québec Availability | Avg. Processing Days* | Median Prevailing Wage (QC, 2024) | Extra Québec Steps |

| Global Talent Stream | Yes | 7 working days | ≥ $46.15 /h (software engineers) | CAQ; French contract; OHS proof |

| High‑Wage | Yes | 21–29 working days | ≥ $29.50 /h (all sectors median) | Same as above |

| Low‑Wage | Restricted | 53 working days | $26.00 /h median cap | CAQ + $1 200 return airfare + 10 % cap |

| Facilitated LMIA | 76 occupations | 45–60 working days | Mirrors high‑wage figures | Ads waived; French docs mandatory |

*Service Canada processing dashboard

Financial Exposure — Federal vs CNESST

| Violation Type | Federal Penalty (ESDC) | Québec Penalty (CNESST) |

| Inadequate TFW records | Up to $100 k per infraction (Category A)** | $25 /day late wage stmt + monthly interest (prime + 3 %) |

| Repeated non‑compliance | Ban 1–10 yrs + public registry listing | Payroll account suspension; directors jointly liable |

| Housing/OHS breach | $50 k + corrective order | CNESST injury surcharge + fines up to $80 k (serious) |

**Category A includes forged documents or willful misrepresentation under IRPR 209.97.

Cost reality: A single forged payslip can incur a $100 k federal fine plus CNESST wage‑statement penalties and interest, often exceeding $8 k before resolution.

Implications for Immigrants & HR Teams

- Longer Onboarding: TEER 4‑5 roles now average 10 weeks from job offer to entry—a 40 % increase versus 2023.

- Dual Renewals: Nearly 12 % of Québec TFW extensions are refused yearly due to missed CAQ renewal, according to MIFI’s 2024 audit sample.

- Empowered Workers: CNESST logged 1 478 TFW complaints in 2024 (+22 % YoY); Spanish factsheets rank as its most‑downloaded resource, confirming rising worker awareness.

Action Plan — From Quick Wins to Long‑Term Fixes

| Timeline | HR Action | Compliance Payoff |

| Next 30 days | Build bilingual compliance matrix; cross‑audit 2024 files | Closes French‑doc gaps; primes for 6‑yr rule |

| Quarterly | Review Simplified‑LMIA list + StatsCan CMA jobless data | Enables pro‑active recruiting shifts |

| Every Pay Period | Sync payroll export with CNESST API upload | Eliminates wage‑statement arrears risk |

| Annually (Jan 15‑Mar 15) | File Statement of Wages; pre‑pay OHS premiums; schedule mock audit | Zero $25/day fines; stress‑tests retention system |

| Ongoing | Automate CAQ/LMIA/Permit expiry alerts 90‑60‑30 days ahead | Prevents status lapses & emergency travel costs |

Why It Matters

Québec’s immigration‑labour ecosystem is tightening faster than any other Canadian jurisdiction: fewer fast‑track roles, sharper low‑wage caps and more rigorous OHS enforcement. For HR, the message is plain, compliance maturity is now a strategic differentiator. Companies that master bilingual documentation, data‑synced payroll and proactive renewal calendars will not only dodge fines but also secure talent faster in an increasingly competitive market.

Take Action Today

Even reputable, well-resourced employers have faced penalties for preventable mistakes. The best defense is readiness. Book a free immigration compliance call with the experts on our team.

Let’s get your demo started

Book a demo

You May Also Like

These Related Stories

Why Employers End Up on Canada’s Non-Compliance List

Every year, dozens of Canadian employers find themselves publicly listed as non-compliant with the Temporary Foreign Worker Program (TFWP) or the Inte …

Link LMIA to PR: Boost Express Entry Points and Long-Term Retention

Many employers see the LMIA as the end goal, but it can also be a gateway to permanent residency (PR).

The Hidden Costs of Non-Compliance: Beyond the Fine

Many Canadian employers assume that immigration compliance is only about avoiding fines. But regulatory breaches often lead to severe indirect costs, …